Navigating Subprime Auto Deals: A Deep Dive into AmeriCredit 2020-3

Unraveling the complexities and mastering prompt creation for analyzing subprime auto transactions

Today we’re going to look at a couple of things:

Can we teach ChatGPT to do be a surveillance analyst in the Subprime auto market

What does it already know about this space without me feeding it a ton of new information.

We'll begin, like always, by setting the stage for ChatGPT by clearly outlining our expectations for its responses. This technique, known as priming the model, helps concentrate its focus and, in my opinion, results in more targeted answers (for a deeper dive into this concept, feel free to explore some of our previous blog posts).

For this conversation respond as though you are an expert in credit analysis at an asset management firm. Specifically you have worked with ABS transactions and are an expert in Auto Loan and Lease securitizations. You have worked at buy side firms as well as at a credit rating agency. You are an expert at creating committee documents for investment or rating decisions. Your name is Isabella.As you might recall, I enjoy assigning names to the bots during these conversations. I feel that this touch of personalization adds a human element to the interaction and serves as a reminder to engage in a more natural conversation with the bot, rather than solely focusing on crafting flawless 'one-shot' prompts.

Okay, let’s start asking Isabella what she knows about this space.

Are you aware of the following document: "DBRS Morningstar Master U.S. ABS Surveillance" It is a rating methodology for surveillance at DBRS, a Credit Rating AgencyWell, maybe unsurprisingly, she does know about this document and can tell me about it:

As an AI language model, I am aware of a wide range of documents, including the "DBRS Morningstar Master U.S. ABS Surveillance" document. DBRS Morningstar is a global credit rating agency that provides credit ratings, research, and risk analysis for various types of securities, including Asset-Backed Securities (ABS). The "Master U.S. ABS Surveillance" document outlines their rating methodology for ongoing surveillance of U.S. ABS transactions.

This methodology covers a variety of asset classes, such as auto loans, credit card receivables, student loans, and other types of consumer loans. The purpose of the ongoing surveillance is to ensure that the credit ratings assigned to these transactions remain accurate and up-to-date, reflecting the current performance and credit quality of the underlying assets.

The surveillance process typically involves monitoring the performance of the underlying assets, assessing the credit enhancement levels, reviewing the deal structures, and analyzing various factors, such as macroeconomic conditions, industry trends, and regulatory developments. Based on this analysis, DBRS Morningstar may decide to maintain, upgrade, or downgrade the credit ratings for the ABS transactions under review.

Is Isabella really familiar with this document though?

Can you identify 5 reasons why a subprime auto loan securitization may be downgraded based on this methodology?Based on the DBRS Morningstar Master U.S. ABS Surveillance methodology, there can be various reasons for downgrading a subprime auto loan securitization. Here are five potential reasons:

Deterioration in the performance of the underlying assets: A significant increase in delinquencies, defaults, or loss rates in the underlying subprime auto loans could signal a higher risk of losses for the securitization, which may prompt a downgrade.

Insufficient credit enhancement: Credit enhancement levels, such as overcollateralization or subordination, may be deemed inadequate to absorb potential losses from the underlying subprime auto loans. This could lead to a downgrade if the credit enhancement does not provide enough protection for the rated tranches.

Changes in macroeconomic conditions: Economic factors, such as a recession or high unemployment rates, can adversely affect the performance of subprime auto loans. A worsening economic environment could increase the likelihood of borrower defaults, which may lead to a downgrade of the securitization.

Adverse industry trends: Negative trends in the auto industry, such as declining used car values or tightening credit conditions, could impact the recovery rates and refinancing options for the underlying subprime auto loans, making it more difficult for borrowers to stay current on their loans. This could result in a downgrade of the securitization.

Servicer or originator issues: Operational issues with the servicer or originator of the loans, such as financial instability, regulatory problems, or poor servicing practices, can affect the overall performance of the securitization. If these issues are deemed significant enough to impact the credit quality of the securitization, a downgrade may be warranted.

It's important to note that the specific reasons for a downgrade may vary depending on the unique characteristics of the subprime auto loan securitization and the factors considered in the DBRS Morningstar methodology.

Wow, I must say I'm impressed. While this response may not encompass every aspect of the Master Surveillance methodology, it does pinpoint key areas that could lead to a downgrade. Keep in mind, this is a Master ABS methodology and not specific to subprime auto. It would be interesting to explore methodologies from other rating agencies as well, but we'll save that for another time.

Now, let's see what Isabella knows about a specific deal. AmeriCredit Automobile Receivables Trust 2020-3 (AMCAR 2020-3) was originated before September 2021, so Isabella should have some knowledge about it.

Let's look at AmeriCredit Automobile Receivables Trust 2020-3, this is rated by DBRS Morningstar and I will share with you the details of their rating report.Great! Please provide the details of the AmeriCredit Automobile Receivables Trust 2020-3 rating report, and I will be happy to help you analyze the deal and answer any questions you may have.

I asked Isabella about the presale report, rating report, and surveillance reports, but it seems she wasn't familiar with those documents. So, we'll move forward and try to provide her with some of that information.

Since we're not using the API and ChatGPT 4 doesn't have direct access to the internet (without the Plugin functionality), we'll have to be a bit creative in providing information through the web interface. I'll go ahead and copy/paste parts of the rating report into the web interface, asking it not to analyze the content yet, but just to confirm receipt. I won't show all these prompts, but you get the idea.

No need to worry if the formatting of the copy/paste looks weird, Isabella will figure it out. Here is how she responded:

YES, I have received the Executive Summary for AmeriCredit Automobile Receivables Trust 2020-3. Please let me know if you'd like me to analyze or provide any information based on the summary.

After having fed Isabella this entire rating report, let’s see what she understands about this deal.

Can you give me a summary of this deal? Are there any unique features?Isabella’s response:

Summary of AMCAR 2020-3 deal:

This is an asset-backed securities (ABS) transaction backed by a pool of subprime auto loan contracts.

The total pool size is $1,199,940,245, with a weighted average FICO score of 585 and a weighted average remaining term of 66 months.

This is the first DBRS Morningstar rated transaction to include loans with original loan terms of 76-84 months, which represent 5.0% of the final pool. These loans have a higher FICO (592) and lower LTV (102%) than the overall pool.

The transaction has a capital structure comprising various classes of notes, including Class A, B, C, D, and E notes, with different credit enhancement levels, coupons, and ratings.

Credit enhancement for the transaction consists of overcollateralization (OC), subordination, a reserve account, and available excess spread.

The deal features a fully funded nondeclining reserve account equal to 2.50% of the initial pool balance.

Unique features:

The inclusion of loans with extended original loan terms (76-84 months) in this deal is a unique feature, representing 5.0% of the final pool.

The pool has a higher seasoning due to approximately 3.7% in called collateral originated in the 3rd and 4th quarter of 2015.

The transaction has seen stable loan characteristics for recent AMCAR securitizations with a notable trend of a continued high percentage of loans for new vehicles, which is partly driven by subvention to boost new vehicle sales.

If you require any more information or analysis, feel free to ask.

Oh yes, I will require more information, but this is a great start. 😄

How do we go about writing a surveillance report for this deal that follows the DBRS Morningstar surveillance methodology?Isabella provides a high-level overview of the approach to writing a surveillance report. It seems to be quite accurate, although it remains somewhat broad in scope.

DBRS Morningstar is a credit rating agency that provides methodologies for various financial analyses, including surveillance of asset-backed securities. To write a surveillance report that follows DBRS Morningstar's surveillance methodology, you should follow these general steps:

Understand the methodology:

Read and familiarize yourself with the specific DBRS Morningstar surveillance methodology applicable to the asset-backed security (ABS) in question. The methodology will provide guidance on the key risk factors and performance metrics that you should consider in your analysis.

Data collection:

Collect all the relevant data, including the latest transaction data, financial statements, and any other relevant information that would help you assess the performance of the ABS.

Performance assessment:

Analyze the performance of the ABS by calculating and assessing various performance metrics such as delinquency rates, default rates, prepayment rates, and recovery rates, as guided by the DBRS Morningstar methodology.

Risk factor analysis:

Evaluate the key risk factors outlined in the DBRS Morningstar methodology, such as credit risk, interest rate risk, prepayment risk, and any other relevant risks. Assess how these risk factors may impact the performance of the ABS and its credit rating.

Stress testing and scenario analysis:

Conduct stress tests and scenario analyses based on the DBRS Morningstar methodology to evaluate how the ABS might perform under various economic conditions or other stress scenarios.

I've trimmed down that response a bit to save space in this post, but you get the general idea. Now, let's rephrase the prompt to make it more specific.

Going forward, please respond as though you have studied the DBRS Morningstar Surveillance Methodology for ABS and are an expert in subprime auto deals like FCAT 2020-4 and AMCAR 2020-3. What specific performance data do you require to analyze pool performance for AMCAR 2020-3?Here’s an actionable response from Isabella:

As an expert in subprime auto deals like FCAT 2020-4 and AMCAR 2020-3 and having studied the DBRS Morningstar Surveillance Methodology for ABS, the specific performance data required to analyze pool performance for AMCAR 2020-3 includes the following:

Delinquency rates:

30+ days delinquent

60+ days delinquent

90+ days delinquent

Cumulative net losses:

Calculate the cumulative net loss percentage for the pool by dividing the cumulative net losses by the original pool balance.

Loss severity:

Calculate the loss severity by dividing the total loss amount by the original loan balance for each charged-off loan.

Recovery rates:

Calculate the recovery rate by dividing the recovered amount by the charged-off loan balance.

Prepayment rates:

Calculate the prepayment rate by dividing the total prepayments by the outstanding pool balance.

Credit enhancement levels:

Assess the available credit enhancement, such as overcollateralization and subordination, to understand how much protection is available for the rated tranches.

Pool composition:

Analyze the remaining pool's composition, including the distribution of loans by credit score, loan-to-value (LTV) ratio, debt-to-income (DTI) ratio, and other relevant factors.

Servicer performance:

Evaluate the performance of the servicer in managing the pool, including their effectiveness in loss mitigation, recovery efforts, and other servicing practices.

Collateral performance:

Review the performance of the underlying collateral, such as the value of the vehicles and their depreciation rates.

By gathering and analyzing this performance data, you can assess the pool performance for AMCAR 2020-3 and make informed decisions about its credit quality and potential risks.

Alright, for those of you who analyze subprime auto deals, let me know in the comments how accurate the outline above is. I'm a tech enthusiast, not an analyst, but from my perspective, it's a solid outline of how to approach the subject. Now, let's have Isabella dive into delinquency rates

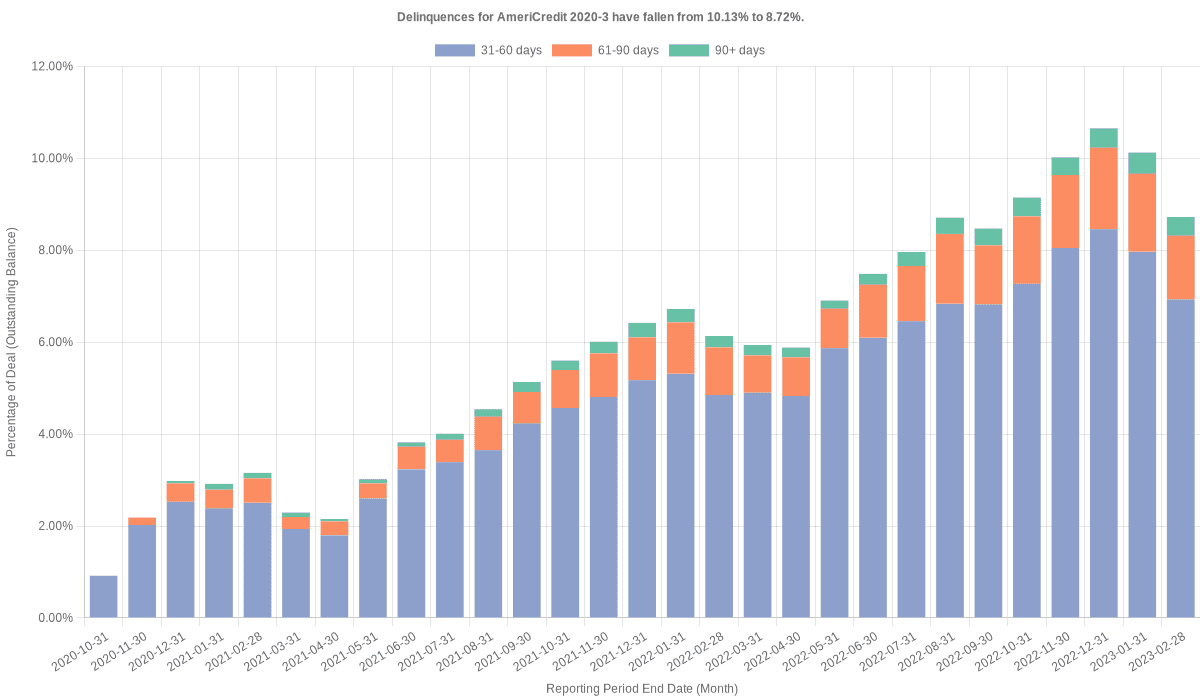

Delinquency data is reported in Edgar and DealCharts does a fabulous job of pulling down this data and doing two things: 1) creating valuable charts of data like this for ABS/CMBS deals, and 2) making all of this data accessible in a more user-friendly format through Snowflake. For brevity's sake, I am going to pull down some of that information in a csv and copy/paste it in (you can find that here in a count.co dashboard, just right click and download CSV). But, you can see below an example of a delinquencies chart from DealCharts for AMCAR 2020-3.

Here is a file of the delinquency data for AMCAR 2020-3, can you compare this data vs the initial deal assumptions?

REPORTINGPERIODENDINGDATE DQ_STATUS DQ_STATUS_FRIENDLY TOTALOUTSTANDING

2022-03-31 d30 31-60 days 0.04900878

2021-11-30 d60 61-90 days 0.0094677

2022-07-31 d90 90+ days 0.00302201

2022-07-31 d60 61-90 days 0.01199017

2022-09-30 d90 90+ days 0.00363381

2020-12-31 d60 61-90 days 0.00399507

2021-10-31 d90 90+ days 0.00203572

...Now, this response reminded me that I did not copy/paste in the entire rating report, some of the collateral, assumptions and scenarios were maintained in the Appendix…Isabella let’s me know that she needs more info:

To compare the delinquency data for AMCAR 2020-3 against the initial deal assumptions, we need to know the initial deal assumptions for the delinquency rates. However, since you have provided the delinquency data, we can analyze the delinquency rates for the 31-60 days, 61-90 days, and 90+ days categories.

Below is the average delinquency rate for each category, calculated from the provided data:

31-60 days (DQ_STATUS_FRIENDLY: d30):

Average delinquency rate: 0.0467 (4.67%)

61-90 days (DQ_STATUS_FRIENDLY: d60):

Average delinquency rate: 0.0086 (0.86%)

90+ days (DQ_STATUS_FRIENDLY: d90):

Average delinquency rate: 0.0023 (0.23%)

Now, compare these average delinquency rates against the initial deal assumptions for AMCAR 2020-3. If the current delinquency rates are significantly higher than the initial assumptions, it might indicate a higher risk than initially anticipated. On the other hand, if the delinquency rates are lower or in line with the initial assumptions, it would suggest that the deal is performing as expected or better.

Keep in mind that other factors such as pool composition, credit enhancement levels, and macroeconomic conditions should also be considered when evaluating the performance of AMCAR 2020-3.

So, it seems ChatGPT is looking at the average delinquency over the course of the deal rather than examining it month over month. But, we can address that later. First, let me grab the appendix of deal details and paste it in. To find a direct link to the current performance report for this deal (or other deals), as well as the prelim and final rating reports, Finsight offers great integration with DBRS Morningstar and can directly link these documents for you. Here's a link to the deal details we've been exploring in this post: AMCAR 2020-3 - Finsight Details. Below is the start of the prompt to paste that data in, and I'll spare you all the text. Remember, don't worry if the formatting looks off; Isabella knows how to handle it:

Here are some details for AMCAR 2020-3 from the rating report:

... [simply copy/paste in all of the text from the Appendix A - Cashflow Details]Thank you for providing the details of the AMCAR 2020-3 deal from the rating report. Based on the information, we can analyze the deal's performance in light of the provided delinquency data.

From the rating report, we can see that the DBRS Morningstar Expected Loss is 9.35%, and the recovery rate is 40%. We can compare these figures with the delinquency rates we calculated earlier:

31-60 days (DQ_STATUS_FRIENDLY: d30):

Average delinquency rate: 0.0467 (4.67%)

61-90 days (DQ_STATUS_FRIENDLY: d60):

Average delinquency rate: 0.0086 (0.86%)

90+ days (DQ_STATUS_FRIENDLY: d90):

Average delinquency rate: 0.0023 (0.23%)

Using the recovery rate, we can estimate the loss rate for each delinquency category:

31-60 days: Loss rate = 4.67% * (1 - 40%) = 2.80%

61-90 days: Loss rate = 0.86% * (1 - 40%) = 0.52%

90+ days: Loss rate = 0.23% * (1 - 40%) = 0.14%

Total estimated loss rate = 2.80% + 0.52% + 0.14% = 3.46%

The estimated loss rate based on the provided delinquency data (3.46%) is lower than the DBRS Morningstar Expected Loss (9.35%). This suggests that the performance of AMCAR 2020-3 is better than initially expected.

However, it's important to note that this analysis is based solely on the delinquency data and does not take into account other factors such as prepayments, changes in the macroeconomic environment, or the performance of individual loans within the pool. For a more comprehensive assessment, consider examining these factors as well.

I haven’t corrected the fact that it’s looking at averages yet, let’s do that and see what it thinks:

Can you compare the February 2023 delinquencies vs the initial deal assumptions?To compare the February 2023 delinquencies against the initial deal assumptions, we need to look at the DBRS Morningstar Expected Loss provided in the initial deal information:

DBRS Morningstar Expected Loss: 9.35%

Now, let's compare this with the total delinquency percentage for the month of February 2023:

Total delinquency percentage (February 2023): 8.723495%

When comparing these percentages, the total delinquency percentage for February 2023 (8.723495%) is slightly lower than the initial expected loss assumption of 9.35%. This indicates that the deal is performing slightly better than initially anticipated in terms of delinquencies. However, it's essential to continue monitoring the performance and other factors, such as prepayment speed and recovery rates, to have a comprehensive understanding of the deal's performance over time.

What is the total delinquency percentage for the month of February 2023?To calculate the total delinquency percentage for the month of February 2023, we can look at the delinquency rates provided earlier for that month:

31-60 days delinquent (D30): 0.0692534

61-90 days delinquent (D60): 0.01391453

90+ days delinquent (D90): 0.00406702

Now, let's sum up these delinquency rates:

0.0692534 (D30) + 0.01391453 (D60) + 0.00406702 (D90) = 0.08723495

The total delinquency percentage for the month of February 2023 is 8.723495%.

How cool, this actually ties out with the Performance Analytics Report as of Feb 2023 data from DBRS Morningstar:

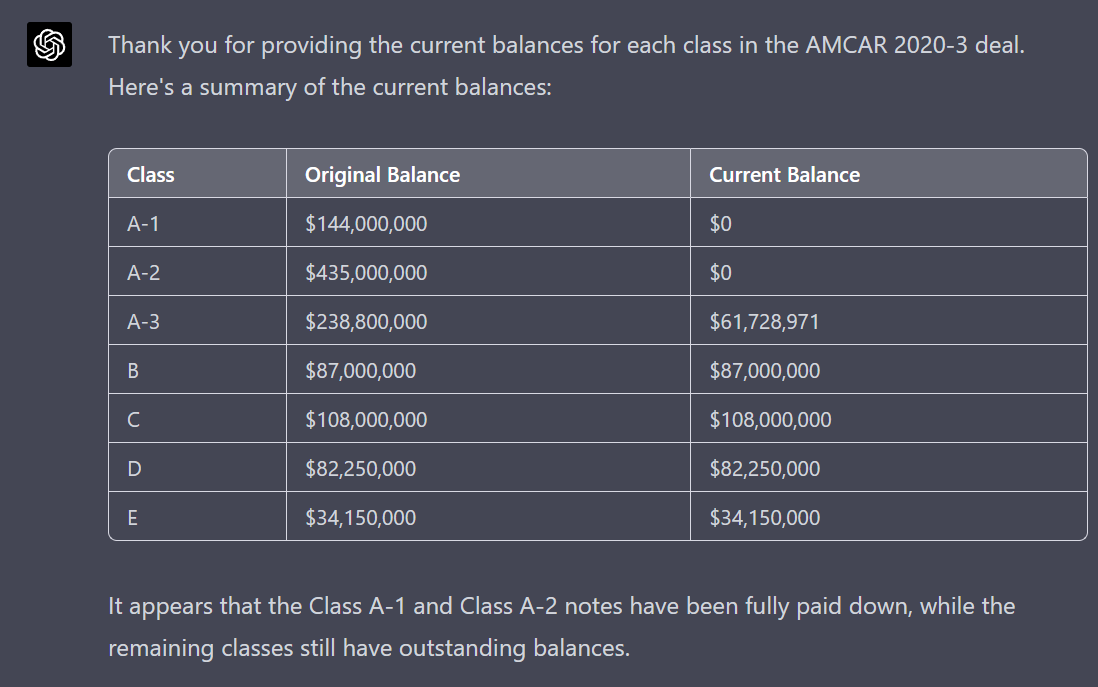

What about DQ $ (Delinquency dollar amount) - I assume this is the delinquency percentage * the current balances? I am not sure on that, but, first let’s feed her the current balances:

Here are the current balances on the deal:

Class Original Balance Current Balance

Class A-1 144000000 0

Class A-2 435000000 0

Class A-3 238800000 61728971

Class B 87000000 87000000

Class C 108000000 108000000

Class D 82250000 82250000

Class E 34150000 34150000She makes it look a lot nicer :)

Now we’ll ask her to calculate the total delinquency dollar amount:

Can you calculate the total delinquency dollar amount based on the current balances and most recent month's delinquency rates?Sure, let's calculate the total delinquency dollar amount using the most recent month's delinquency rates and the current outstanding balances for each class.

As previously calculated, the most recent month's delinquency rates are:

31-60 days delinquent (D30): 0.07965875

61-90 days delinquent (D60): 0.01696159

90+ days delinquent (D90): 0.00463332

The total outstanding balance for the remaining classes is:

$61,728,971 (A-3) + $87,000,000 (B) + $108,000,000 (C) + $82,250,000 (D) + $34,150,000 (E) = $373,128,971

Now, let's calculate the total delinquency dollar amount for each delinquency category:

31-60 days delinquent (D30): $373,128,971 * 0.07965875 = $29,724,822.57

61-90 days delinquent (D60): $373,128,971 * 0.01696159 = $6,327,802.46

90+ days delinquent (D90): $373,128,971 * 0.00463332 = $1,727,187.46

Adding up all the delinquency amounts, we get:

$29,724,822.57 (D30) + $6,327,802.46 (D60) + $1,727,187.46 (D90) = $37,779,812.49

The total delinquency dollar amount based on the current balances and most recent month's delinquency rates is $37,779,812.49.

Well, we’re off by ~2M, and while I do believe the calculation is being done correctly as prescribed, it may not actually be current balance * total dq%. If you know otherwise, let me know in the comments.

In any case, it's evident how potent this approach can be. It's remarkably simple to venture down numerous paths and collaborate with ChatGPT (Isabella, in this instance) to delve into various aspects of a Surveillance Report for a Subprime Auto deal.

For a hands-on experiment, follow the prompts outlined in this article and begin asking your own primed version of ChatGPT to calculate other performance metrics, such as recovery rates, loss severity, and prepayments. ChatGPT often knows where to locate the required data sets, allowing you to work together and explore these calculations firsthand. Share your experiences in the comments!

Happy Prompting!